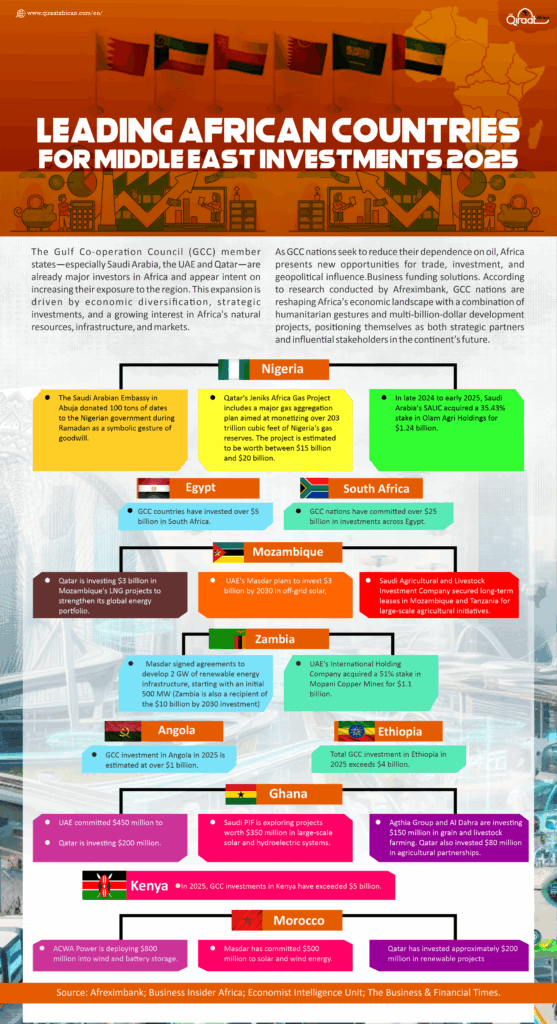

The Gulf Cooperation Council (GCC) member states—especially Saudi Arabia, the UAE, and Qatar—are already major investors in Africa and appear intent on increasing their exposure to the region. This expansion is driven by economic diversification, strategic investments, and a growing interest in Africa’s natural resources, infrastructure, and markets.

As GCC nations seek to reduce their dependence on oil, Africa presents new opportunities for trade, investment, and geopolitical influence. Business funding solutions. According to research conducted by Afreximbank, GCC nations are reshaping Africa’s economic landscape with a combination of humanitarian gestures and multi-billion-dollar development projects, positioning themselves as both strategic partners and influential stakeholders in the continent’s future.

Country-by-Country Breakdown of Major GCC Investment Highlights:

Nigeria

- The Saudi Arabian Embassy in Abuja donated 100 tons of dates to the Nigerian government during Ramadan as a symbolic gesture of goodwill.

- Qatar’s Jeniks Africa Gas Project includes a major gas aggregation plan aimed at monetizing over 203 trillion cubic feet of Nigeria’s gas reserves. The project is estimated to be worth between $15 billion and $20 billion.

- In late 2024 to early 2025, Saudi Arabia’s SALIC acquired a 35.43% stake in Olam Agri Holdings for $1.24 billion.

Egypt

- GCC nations have committed over $25 billion in investments across Egypt.

South Africa

- GCC countries have invested over $5 billion in South Africa.

Mozambique

- Qatar is investing $3 billion in Mozambique’s LNG projects to strengthen its global energy portfolio.

- UAE’s Masdar plans to invest $3 billion by 2030 in off-grid solar, wind, and hydroelectric projects.

- Saudi Agricultural and Livestock Investment Company secured long-term leases in Mozambique and Tanzania for large-scale agricultural initiatives.

Zambia

- Masdar signed agreements to develop 2 GW of renewable energy infrastructure, starting with an initial 500 MW (Zambia is also a recipient of the $10 billion by 2030 investment).

- UAE’s International Holding Company acquired a 51% stake in Mopani Copper Mines for $1.1 billion.

Angola

- GCC investment in Angola in 2025 is estimated at over $1 billion.

Ethiopia

- Total GCC investment in Ethiopia in 2025 exceeds $4 billion.

Ghana

- UAE committed $450 million to solar and wind projects.

- Qatar is investing $200 million.

- Saudi PIF is exploring projects worth $350 million in large-scale solar and hydroelectric systems.

- Agthia Group and Al Dahra are investing $150 million in grain and livestock farming. Qatar also invested $80 million in agricultural partnerships.

Kenya

- In 2025, GCC investments in Kenya have exceeded $5 billion.

Morocco

- ACWA Power is deploying $800 million into wind and battery storage.

- Masdar has committed $500 million to solar and wind energy.

- Qatar has invested approximately $200 million in renewable projects.

ـــــــــــــــــــــــ

* Source: Afreximbank; Business Insider Africa; Economist Intelligence Unit; The Business & Financial Times.