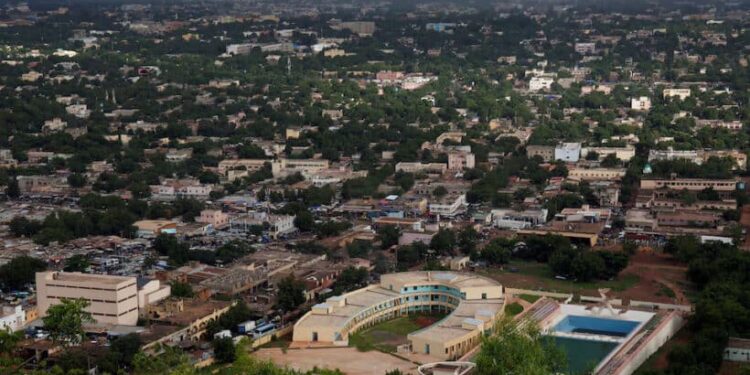

Mali has taken a 51% stake in a new industrial‑explosives venture with China’s Auxin Chemical Technology, its Council of Ministers said, tightening state control over critical mining inputs and extending Beijing’s industrial expansion in the Sahel region.

Mali, Burkina Faso and Niger, which have all experienced recent military coups, are pivoting towards China and Russia, unsettling Western investors as their governments push ahead with new gold‑refining, security, and uranium deals — part of a broader Sahel realignment.

Mali’s 2023 mining code raised state equity in mining projects and strengthened local‑content requirements, part of sweeping reforms to extract more income from the sector.

Auxin Chemical Technology, a subsidiary of China’s NORINCO Group, already supplies industrial explosives to six countries in Africa’s rapidly expanding mining sector, according to its project listings.

CHINA’S AUXIN TO FUND EXPLOSIVES PLANT CONSTRUCTION

The Malian subsidiary, FARATCHI‑CO SA, first announced in 2024, will produce civil‑use explosives for Mali’s gold, lithium and quarrying operations, according to the statement read on state television late on Friday.

The majority state ownership aims to “strengthen the management of civil‑use explosives, promote the development of a local industry, enhance oversight, and ensure security”, it said.

Auxin will hold the remaining 49% and provide financing and technical expertise for the plant, expected to be built within 12 months. The government did not state the cost of the plant.

Mali, one of Africa’s top gold producers, hosts about 30 industrial gold operations — including 15 large mines — alongside two major lithium mines and numerous quarrying sites, according to the Mines Ministry.

Challenges including government reforms and insecurity helped to prompt a 23% fall in gold output last year.