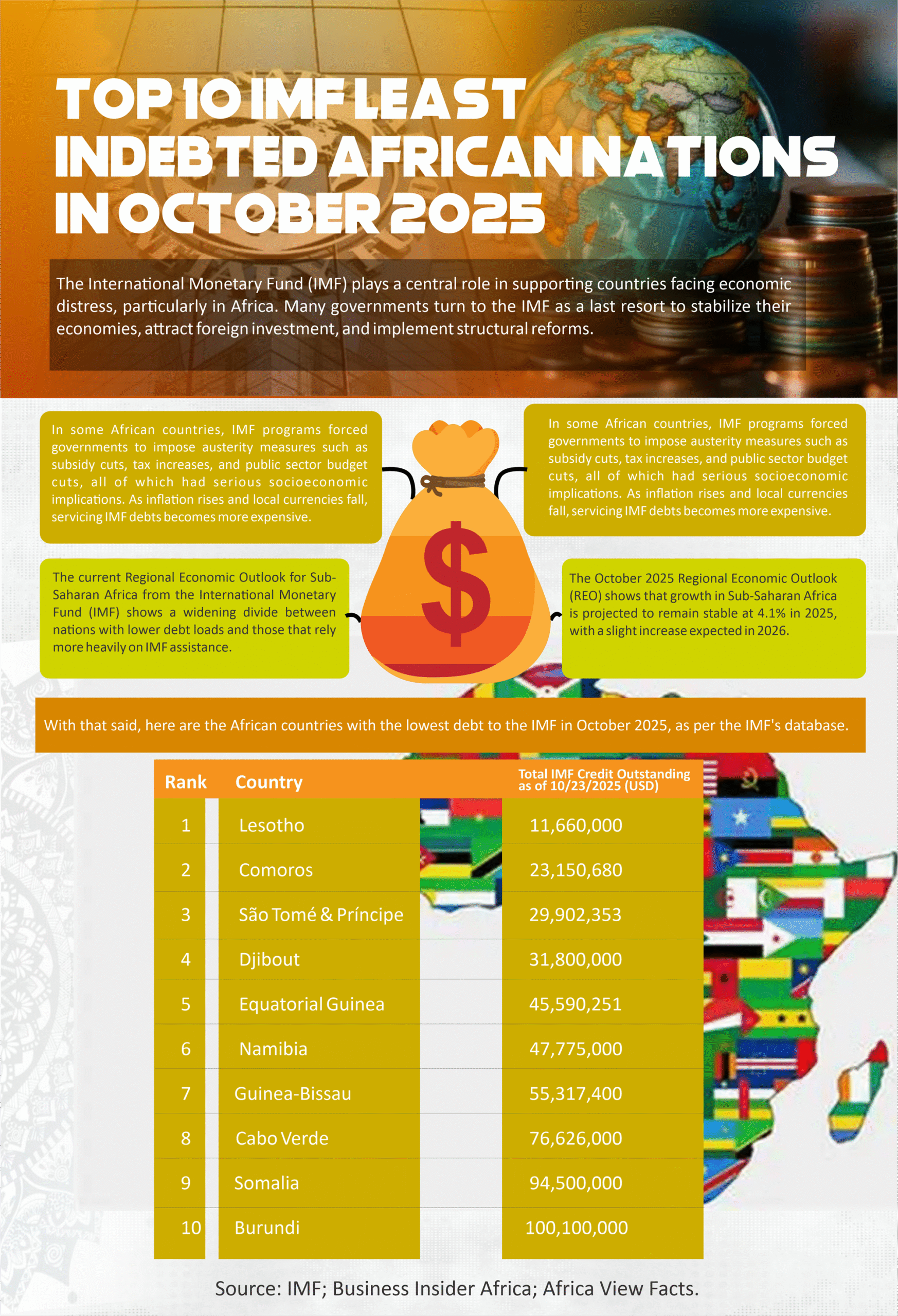

The International Monetary Fund (IMF) plays a central role in supporting countries facing economic distress, particularly in Africa. Many governments turn to the IMF as a last resort to stabilize their economies, attract foreign investment, and implement structural reforms.

In some African countries, IMF programs forced governments to impose austerity measures such as subsidy cuts, tax increases, and public sector budget cuts, all of which had serious socioeconomic implications. As inflation rises and local currencies fall, servicing IMF debts becomes more expensive.

The current Regional Economic Outlook for Sub-Saharan Africa from the International Monetary Fund (IMF) shows a widening divide between nations with lower debt loads and those that rely more heavily on IMF assistance.

The October 2025 Regional Economic Outlook (REO) shows that growth in Sub-Saharan Africa is projected to remain stable at 4.1% in 2025, with a slight increase expected in 2026.

With that said, here are the African countries with the lowest debt to the IMF in October 2025, as per the IMF’s database.

Country Total IMF Credit Outstanding as of 10/23/2025 (USD)

- Lesotho 11,660,000

- Comoros 23,150,680

- São Tomé & Príncipe 29,902,353

- Djibout 31,800,000

- Equatorial Guinea 45,590,251

- Namibia 47,775,000

- Guinea-Bissau 55,317,400

- Cabo Verde 76,626,000

- Somalia 94,500,000

- Burundi 100,100,000

ـــــــــــــــــــ

* Source: IMF; Business Insider Africa; Africa View Facts.