Islamic finance has become a modern phenomenon whose principles and concepts have traveled across the four walls of the globe. In their fifth operational decade, Islamic financial sectors have recorded consequential successes globally, replicating mainly the financial services and facilities operational in the conventional financial industries.

Islamic finance’s entrance into Nigerian financial sectors is in its third decade. The introduction of Islamic finance in Nigeria dates back to the late nineties, when the Banks and Other Financial Institutions Decree (BOFID), now BOFIA, was promulgated during the military regime by the Supreme Military Council of Nigeria. [1]

In 2011, the Central Bank of Nigeria (CBN) introduced a new banking model that aims to direct banking activities to focus only on core banking businesses. The Model approved the establishment of three major sectors under the guidelines of the Banks and Other Financial Institutions Act (BOFIA) 1991, as amended, which include (i) Commercial Banks; (ii) Merchant Banks; and (iii) specialty banks. Specialized Banks comprise non-interest financial institutions whose models are broadly categorized into two categories: (1) Non-interest banking and finance based on Islamic commercial jurisprudence; (2) Non-interest banking and finance based on any other established non-interest principle [2].

The non-Interest financial institutions based on Islamic commercial jurisprudence are not only limited to banking activities but also include Islamic merchants, Islamic microfinance banks, Islamic Takaful operators, Islamic capital markets, primary mortgage institutions licensed by the CBN to offer Islamic financial services, finance companies licensed by the CBN to provide financial services, and Islamic Forex, all operating either as full-fledged or as subsidiary windows under existing conventional financial institutions. For more than a decade, Islamic finance has been actively operational in the Nigerian financial sector as an alternative financing system for a larger Nigerian population that has been financially excluded, especially among Muslims whose religious ethics and values disapprove of the principles of conventional finance.

Since its introduction, Islamic finance in Nigeria has faced some teething challenges, some of which are erroneous concepts coming from the public about the products and policies of the Nigerian Non-Interest Financial institutions (NIFIs). While some Non-Muslims mischievously promote the Islamization agenda polemic in order to discourage the public from accepting Islamic financial products, some Muslims have equally challenged the Islamicity of the processes, policies, and products of the Nigerian Non-Interest financial institutions (NIFIs). Unfortunately, and amidst these two paradoxical polemics, Islamic financial sectors in Nigeria have suffered setbacks, low penetration, and a lack of public trust, among other challenges.

The Islamization Polemic

The introduction of Islamic banking and other Non-interest Financial Institutions in Nigeria was welcomed with heated debates and fiery polemics. In particular, Islamic or Non-interest Banking was erroneously misconstrued as a tool for Islamic propagation; hence, it received scorching attacks from many ethnic groups and religious bodies in Nigeria, as they believed the system was an attempt to promote Islam with public funds or as a government machinery to endorse a kind of religious coloration that may tend to favor the Islamic religion and the Muslims. [3]

The fears of those opposing the Islamic financial system in Nigeria, mostly Christians, are the allegation that the financial system will violate the religious neutrality provided for in the Nigerian Constitution, cause likely discrimination against non-Muslims in its operation and supervision, and be an agitation for an alleged plot to Islamize the country through crooked means. [4] The inclusion of Islamic terms such as “Islamic” and “Shariah” in the documents, drafts, charters, and detailed guidelines and regulations of Non-interest banking and other financial institutions in Nigeria has strengthened the notion that Non-interest banks were meant to be floated only by Muslims. [5]

All these and other ethno-religious sentiments were frequently used by Christians and some liberal Muslims to discredit the Islamic financial system. In July 2011, the leadership of the Christian Association of Nigeria (CAN) described Islamic banking as “a plot to Islamize Nigeria” and vowed to resist any plan to Islamize the country under any pretense. [6] Also, the Catholic Archbishop of Lagos, Cardinal Anthony Olubunmi Okogie, condemned Islamic banking in the country because he saw dangers in it. The Diocesan Director of Social Communications has also warned that Islamic banking could compound Islamic extremism already being spearheaded in the country by the terrorist Boko Haram Islamic sect. [7] Hence, the then Governor of the Central Bank was accused of harboring sectarian loyalties and of exacerbating interreligious tensions at a delicate moment, according to Bishop David Bakare. [8]

The foregoing represents the most common explanations rationalizing the Islamization agenda polemic that surrounds Islamic financial operations in Nigeria. While most of these polemics have been frequently spread for more than a decade, it is interesting to note that none of them has passed the test of time as they lack all the required ingredients of credence, reality, and objectivity.

The claim that Islamic banking and financial institutions will facilitate the promotion of the Islamic religion with public funds is not only fallacious but also incongruent with the standing facts and testimonies of Non-interest financial institutions in Nigeria. Throughout a decade of active operation and penetration of Islamic finance in Nigeria, there has been no record of religious favoritism against any institution under the purview of NIFIs. On the contrary, there have been testimonies of good operation and evidence of financial inclusiveness in all the segments of Islamic financial institutions operational in Nigeria.

Many reactions from both Muslims and Christians have belied the above fallacious assertion. According to Sanusi Lamido Sanusi, former Governor of the Central Bank, the Islamic banking system is not for Muslims alone but for everyone, including Christians. [9] According to Sanusi, some non-Muslims should be commended for their support, encouragement, and workable suggestions that helped the CBN navigate through the challenging moment in the history of Islamic banking in Nigeria, but unfortunately, many Nigerians saw the merits of the non-interest finance system but were blinded by religious sentiments. [10]

In one of his interviews with some Media men, Alhaji Sabiu Bello, the Acting Managing Director of J’iz Takful, revealed that their Takaful products are not religious products but rather inclusive services. According to him, “We have a large number of Christian consumers; we have many clients who are Christians or non-Muslims that are patronizing us, and the reason is simple. They have seen the additional value, and we did not treat them differently.” [11]

In his remark on the Noor Takful 2020 surplus distribution occasion, the Pastor of Covenant Church Centre, Peju Oyemade, said that his attendance at the event is a testimony to the non-discrimination of Islamic financial products and instruments. He said, I must commend you; I have not heard of any business organization running this way before. So, it is something commendable, and it also signifies personally to me that this will last for a very long time”. [12]

Over a decade now, Islamic finance has showcased in Nigeria its unique paradigm of banking, the socio-ethical coloration of its insurance system, the social benefits and spoils of its Sukuk instruments, and the humane and ethical models of its mortgage scheme, all devoid of ethno-religious biases.

Another fear surrounding the Islamization polemic of Islamic finance in Nigeria is the fear that it will violate religious neutrality and be discriminatory against non-Muslims in its operation and supervision. Just like the above allegation, this accusation is also groundless and unfounded. Islamic finance in Nigeria has allowed non-Muslims to enter either as customers and subscribers or as operators and workers in its system. According to Sanusi Lamido, as of the time he was being quizzed at the National Assembly over Islamic Bank licensing, 40 percent of the shareholders that had bought JAIZ Bank’s shares were not Muslims. [13]

In an exclusive interview with the Business Day team, Kafilat Araoye, the pioneering managing director and CEO of Lotus Bank, the latest Non-Interest Bank in Nigeria, revealed that their first customer was a non-Muslim, as was their first risk-financing customer. She narrated that Part of their strategy is to educate their customers on the fact that, of the top 20 countries offering Islamic banking, eight are non-Muslim countries. The UK and the US are there. In fact, the US is the largest consumer of non-interest banking. [14]

Even though there was a public outcry from the Christian Association of Nigeria (CAN) concerning the issuance of Sukuk [15], the Nigerian Debt Management Office (DMO) has affirmed that the proceeds of the N100 billion Sukuk were designated for the financing of 25 Road Projects across the six geopolitical zones of the country in order to facilitate the movement of people, goods, and services, thereby contributing to economic growth and development in the country. [16]

Even as operators and workers in the Islamic Financial system, Islamic banking and other financial institutions in Nigeria have allowed non-Muslims to enter the governance and general operations of the industries. Either in banking or another sector, non-Muslims have held enviable roles in Muslim-owned Islamic financial institutions without any sort of religious intimidation. Except in Shariah departments that require a detailed know-how of the Shariah contracts and Islamic commercial laws, non-Muslims have been actively recruited to contribute their professional expertise in Islamic finance development in Nigeria, especially in Treasury, Corporate Governance, Marketing, Legal, and IT departments, especially in some branches domiciled in the Christian-Majority South-East of the country, such as Port Harcourt, where mostly the workers, customer service representatives, bookkeepers, and accounting clerks are non-Muslims.

It is clear from the above discussion that the Islamization polemic surrounding the introduction and operation of Islamic finance in Nigeria is an emotional argument lacking any factual elements. This narrative was spread for more than a decade without any incident affirming its credibility. In contrast, Islamic finance products in Nigeria have proven to be a viable social recipe for the country’s financial exclusion menace and a sustainable financial system that not only competes actively with the existing conventional financial systems but also stands out with its novel, self-appealing, and market-driven financial products.

The Shariah Non-Compliance Polemic

Shariah non-compliance polemic has also engaged the operation of Islamic finance in Nigeria, thus contributing to the slow market penetration and public acceptance of its products. Interestingly, this argument has been frequently advanced by some religiously conscious Muslims whose aversion to conventional financial activities has been premised on Shariah non-compliance grounds.

Shariah risks are one of the operational risks capable of slowing the growth and development of Islamic financial institutions, as they query the islamicity of the operations, instruments, and products of Islamic finance, which poses a perilous challenge to the institutions and stakeholders. According to Genena, “Possible consequences of Shari’ah non-compliance include higher costs, financial losses, liquidity problems, bank failure, industry smearing, financial instability, and reputational risk [17].

The regulatory organizations in the Nigerian Financial system, such as CBN, NAICOM, and SEC, among others, are aware of the great disservice Shariah non-compliance may do to an emerging Islamic Finance market in Nigeria and have thusly provided for globally acceptable standards and regulations that will aid the Shariah compliance of Islamic financial activities both in principle and in practice.

As part of the Shariah compliance actualization, any financial products or instruments operational in Nigerian non-Interest financial institutions must be designed under the purview of the Shariah underlying contracts and models designed and approved by the institutions’ Shariah Supervisory Board (SSB) or Advisory Council of Experts (ACE). All Islamic financial industries must comply with Shariah standards and regulations approved by the Shariah Board of the National Regulatory Body of their host Industry. Islamic banks fall under the supervision of the Central Bank’s Financial Regulations Advisory Council of Experts (FRACE), saddled with monitoring Islamic banking activities; Islamic Capital Markets fall under the supervision of the Security and Exchange Commission’s (SEC) Advisory Council of Experts (ACE), saddled with the responsibilities of monitoring and supervising Islamic market products; and Takaful operators fall under the National Insurance Commission’s (NAICOM) Takaful Advisory Council, which is also saddled with the responsibility of supervising and maintaining the shariah-complaint status of Takaful products in Nigerian Takaful markets. [18]

The Non-Interest financial regulatory bodies in Nigeria are not unaware of the fact that Shariah compliance of Islamic finance operations and activities is sacrosanct and non-negotiable, and they have put every effort on track to ensure the islamicity of Non-Interest Financial Institutions. In 2015, the Minister of State for Finance, Bashir Yuguda, instructed all operators of all Islamic financial products to ensure that their operations comply with globally acceptable standards. He reiterated that “Shariah governance in Islamic financial supervision, regulation, and operation was indispensable for the fulfillment of stakeholders’ expectations and the maintenance of confidence in the overall financial service system. [19]

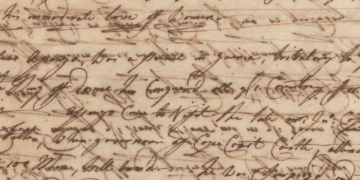

Also in 2022, Nigeria’s Securities and Exchange Commission (SEC) exposed new rules on Shariah Advisory Services for non-interest capital market products and services. [20] The SEC has also echoed the fact that “Shariah governance is crucial considering that compliance with Shariah rules and principles is important in Non-interest Capital Market operations and transactions.” [21] In its new rule, the SEC has stipulated that a Shariah adviser to a fund manager of an Islamic capital market must be “An individual eligible to provide Shariah Advisory services whose requirements should be: Possession of a minimum of a Bachelor’s degree in Shariah with a major in Usul Fiqh (principles of Islamic jurisprudence) or Fiqh Muamalat (Islamic transaction/commercial law) or a person with vast knowledge in Usul Fiqh (principles of Islamic jurisprudence) or Fiqhul-Mu’amalat (Islamic transaction/commercial law) acquired through the Islamic system of education; ability to read and write in Arabic and English, respectively; possession of basic knowledge of business or finance, particularly in Islamic finance and capital markets.” [22]

In its efforts to ensure effective regulation and supervision of Non-Interest Financial Institutions (NIFIs), the Financial Advisory Council of Experts (FRACE) has released its first series of compendiums that contain FRACE’s Shariah resolutions on matters bordering on Islamic financial rulings on certain commercial contracts and resolutions surrounding some products and services deployed by NIFIs. [23] Likewise, in Jaiz Bank, the Advisory Council of Experts (ACE) has published the verdicts and resolutions reached by its Shariah Board between 2011 and 2015 so that the general public can have access to the Shariah justifications for the products and services deployed by the Bank. [24]

The above citations are sufficient proofs of the fact that the Shariah non-compliance allegation cannot be made arbitrarily without citable evidence, as it contradicts the prevailing status of the financial system and contravenes its standing principles and regulatory standards. That being said, it is, however, not far from the truth to note that Islamic financial institutions in Nigeria are still suffering a great deal of challenges as regards human resources management that are commensurate with the set standards for Shariah risk management, whose role is to avert any occurrence of Shariah non-compliance events in the system.

Poor Islamic finance literacy and a shortage of qualified staff remain major factors affecting the operations of NIFIs in Nigeria. In principle, the regulatory bodies in the Nigerian Financial System have put forth efficient standards to mitigate against any Shariah non-compliance violation in NIFIs, but unfortunately, owing to a shortage of genuinely qualified staff across Islamic financial industries in Nigeria, there may be certain human errors and operational risks that can query, if unchecked, the Shariah compliance reality of the system.

However, it is needless to say that many of the Shariah non-compliance arguments targeting some product designs and instruments of Islamic financial operations lack wherewithal academic credibilities as they are a consequence of poor literacy about modern trends in the Islamic financial system that require a specialized study of its operations and Shariah standards for its contracts and commercial activities.

In conclusion, the Islamization and Shariah non-compliance arguments are major bottlenecks thwarting the growth of Islamic finance in Nigeria, thus affecting its desired penetration and acceptance in the country. While the former polemic was erroneously spread by Non-Muslims, the latter was ignorantly blown out of proportion by some Muslims. In reality, these polemics lack any credence as they are just emotional assertions. However, Islamic financial industries in Nigeria retain the formal prerogative to right the wrong by embarking on public awareness and educational programs in order to reiterate the fact that the Islamic finance system in Nigeria is not an Islamization agenda and that it is not a Shariah-non-compliant system.

ـــــــــــــــــــــــ

[1] A. Alaro and I.I. Alao, “Challenges of the Emerging Markets of Islamic Finance in Africa: Nigeria as A Case Study”, International Review of Entrepreneurial Finance, vol. 2, Issue 1, 2019, 20.

[2] Abdullah, N. A. (2016). “Islamic Banking in Nigeria: Issues and Prospects”. Journal of Emerging Economies and Islamic Research, Vol. 4, No. 2.

[3] Aladekomo, A. (2020). Islamic Banking Licensing Controversy, Legality Question and Recent Reforms in Nigeria. Legality Question and Recent Reforms in Nigeria”. Elizade University, P. 3

[4] Ibid, P. 11

[5] Ibid.

[6] Thurston, A. (2011). “Islamic banking stirs controversy in religiously divided Nigeria.” The Christian Science Monitor, retrieved from https://www.csmonitor.com/World/Africa/Africa-Monitor/2011/0627/Islamic-banking-stirs-up-controversy-in-religiously-divided-Nigeria

[7] Op. Cit., Aladekomo.

[8] Op. Cit., Thurston.

[9] Adebusuyi, D. (2011). “Nigeria: Islamic Banking for Christians, Muslims – Sanusi.” Allafrica, retrieved from https://allafrica.com/stories/201107190181.html

[10] Kanabe, M. (2022). “Islamic Finance: Sanusi preaches religious tolerance, hails non-Muslims promoting non-interest banking.” Premium Times, retrieved from https://www.premiumtimesng.com/news/top-news/515706-islamic-finance-sanusi-preaches-religious-tolerance-hails-non-muslims-promoting-non-interest-banking.html

[11] Emejo, J. (2023). “Takaful Insurance Beyond Ethnic, Religion Bias, Says Shehu”. ThisDay, retrieved from https://www.thisdaylive.com/index.php/2023/07/17/takaful-insurance-beyond-ethnic-religion-bias-says-shehu

[12] Op. Cit., Kanabe.

[13] Ibid.

[14] BASHIR IBRAHIM HASSAN (2021). “Islamic banking through LOTUS is breaking religious barriers – Araoye”. BusinessDay, retrieved from https://businessday.ng/interview/article/islamic-banking-through-lotus-is-breaking-religious-barriers-araoye/

[15] Musa Asake (2017). “Sukuk: CAN Condemns FG’s Islamic Bond Plan.” Belivers Portal, retrieved from https://believersportal.com/sukuk-can-condemns-fgs-islamic-bond-plan/

[16] “Using Sukuk to Finance Infrastructure – DMO Inspects Roads financed by Sukuk.” Debt Management Office Nigeria, file available at: https://dmo.gov.ng/fgn-bonds/sovereign-sukuk/2403-using-sukuk-to-finance-infrastructure-dmo-inspects-roads-financed-by-sukuk/

[17] Karim Genena, Shar’ah risk and corporate governance of Islamic banks, International Journal of Business in Society, January 2014, 86.

[18] Habeeblai Jumah (2021). “Jāiz Bank involving in Usury? By: Shaykh Habeeblai Jumah”. The Muslim Voice Nigeria, retrieved from https://muslimvoice.com.ng/2021/09/26/jaiz-bank-involving-in-usury-by-shaykh-habeeblai-jumah

[19] Bassey Udo (2015). “Islamic finance products must comply with global standards – Minister”. The Premium Times, retrieved from https://www.premiumtimesng.com/business/178303-islamic-finance-products-must-comply-with-global-standards-minister.html

[20] Iheanyi Nwachukwu (2022). “Nigeria’s SEC exposes new rule on Shariah Advisory Services

“. Business Day, retrieved from https://businessday.ng/markets/article/nigerias-sec-exposes-new-rule-on-shariah-advisory-services/

[21] Ibid.

[22] Ibid.

[23] Central Bank of Nigeria, Compendium of Resolutions of the Financial Regulation Advisory Council of Experts, Series 1, Abuja, 2022

[24] J’iz Bank plc., Fatwa 2011-2015, Abuja, 2015.