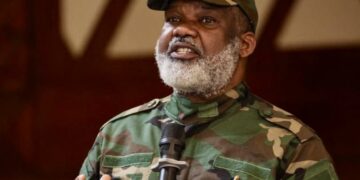

The Director-General of Nigeria’s Budget Office of the Federation, Mr. Tanimu Yakubu, says that President Tinubu’s economic reforms, popularly known as Tinubunomics, are never intended to deliver “instant abundance”.

Yakubu stated in a statement titled ‘Tinubunomics and the Arithmetic of Illusion’ and released on Sunday in Abuja that much of the criticisms against the reforms were built on misleading arithmetic rather than sound economic analysis.

“A striking feature of Nigeria’s current economic debate is the enthusiasm with which huge numbers are circulated and the casualness with which there are assembled.

“This is not an economic analysis. It is an arithmetic illusion,” he said.

Yakubu explained that many viral critiques failed to distinguish between revenue, cash and financing, as well as between federation-wide collections and actual Federal Government budgetary resources.

“These are not technicalities. There are the foundation of public finance,” he said.

According to him, borrowing is often wrongly treated as income, while federation revenues are frequently presented as if there were entirely available to the Federal Government.

“Revenue is not the same as cash available to the Federal Government. Borrowing is not income; it is financing and creates future obligations.

“Federation receipts are not equivalent to what the Federal Government can spend,” Yakubu explained.

He said that critics routinely aggregate tax collections, oil revenues, customs receipts, borrowing and subsidy savings into large headline figures, then question how such sums were spent.

“The result is a dramatic number ₦150 trillion, ₦170 trillion, ₦180 trillion, followed by the question: where did the money go?

“The answer is straightforward: much of it never existed in the form being implied,” he said.

Yakubu explained that fuel subsidy removal did not generate a pool of discretionary cash, but merely closed longstanding fiscal leakages.

“Subsidy reform does not conjure idle cash. It closes a hole.

“The fiscal benefit appears gradually through reduced deficit pressure, improved budgeting discipline and targeted support, not through sudden spendable savings,” he said.

On public debt, he said that much of the recent increase in naira-denominated debt resulted from exchange-rate revaluation of existing external obligations, not fresh borrowing.

“When the exchange rate adjusts, the naira value of dollar-denominated debt rises automatically.

“Treating this accounting effect as new borrowing is a category error,” he added.