South Africa’s finance ministry confirmed on Thursday that it will not go ahead with the proposed increase in value-added tax (VAT) scheduled for May 1. The decision follows significant opposition from political parties and internal tensions within the ruling coalition government.

The National Treasury had initially planned to raise VAT by 1 percentage point over two years as part of the revenue measures for the 2025 national budget. This would have seen an increase of 0.5 percentage points on May 1, with another 0.5 points expected next year. However, the proposal sparked disagreement between the two largest coalition partners, the African National Congress (ANC) and the Democratic Alliance (DA), with both parties at odds over the hike.

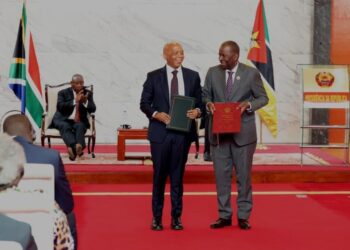

In a statement, the finance ministry confirmed that VAT will remain at 15% for now. Finance Minister Enoch Godongwana will instead introduce a revised version of the Appropriation Bill and the Division of Revenue Bill in the coming weeks, following consultations with political parties and parliamentary committees.

The ministry acknowledged that without the VAT increase, South Africa’s projected revenue is expected to fall short by about 75 billion rand ($4.02 billion) over the medium term. As a result, Parliament will be asked to adjust expenditure in a way that ensures the fiscal sustainability of the country’s finances.

The proposed VAT hike had also faced legal challenges in court, with Finance Minister Godongwana arguing that failing to raise VAT would severely damage state finances. Some smaller political parties suggested alternatives, such as deeper expenditure cuts, but the ministry stated that these proposals would not generate immediate revenue to replace the VAT increase.

While the decision to forgo the VAT hike may ease political tensions in the short term, it also presents a significant fiscal challenge for South Africa’s government as it seeks to balance its budget amidst rising economic pressures.